2019 was an important year for climate and the environment. While global carbon emissions hit a record high, the year also saw growing grassroots activism, from Extinction Rebellion to school climate strikes, along with a huge increase in the number and scope of companies making strategic climate commitments with a climate finance element. Numerous countries across the world also came forward with net zero commitments, such as the UK’s 2050 target set in June 2019. In fact, by the end of 2019, two-fifths of the global economy was covered by existing or intended net zero emissions targets from nations, regions and cities.

Due to a combination of factors, global carbon markets saw a real resurgence in 2019, with the largest volume of carbon credits ever issued by VCS (verified carbon standard) in one year, issuance of the 100 millionth carbon credit by VCS and a 100% increase over 2018 issuances.

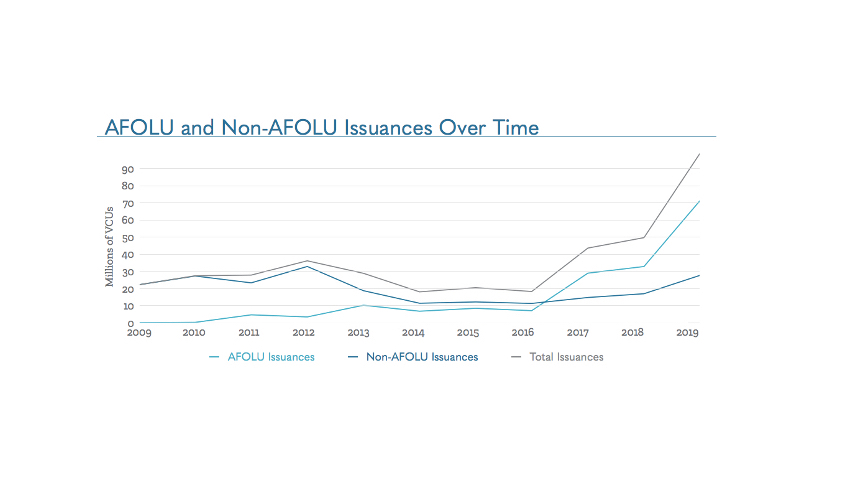

Natural climate solutions continued to be a strong focus for businesses with growing recognition of the science and the critical role nature has to play in reaching global climate goals and addressing the biodiversity crisis. This focus was reflected in the development of global coalitions and corporate announcements and was a key theme at events such as World Economic Forum’s Annual Meeting in Davos. Data released in 2019 by Ecosystem Marketplace showed that the volume of offsets generated by Forestry and Land use activities increased 264% between 2016 and 2018, and according to the VCS, these issuances have outpaced other types of credits since 2016, representing 72% of total issuances in 2019 as opposed to 38% in 2016.

Agriculture, Forestry and other land use (AFOLU) and non-AFOLU project offsets issued between 2009 and 2019

Ecosphere+ sales from the Althelia Climate Fund in 2019 represented more than a quarter of the total market based on number of VCUs issued and more than a third of the market for natural climate solutions VCUs issued.

Voluntary Action

This huge growth in the market was partly due to important corporate commitments made in 2019, and announcements in the first few months of 2020 show a continuing trend towards future growth. Businesses are realising that in order to set and achieve ambitious climate and sustainability targets across Scope 1, 2 and 3, incorporating natural climate solutions is an important part of a transition strategy towards net zero.

Ecosphere+ has helped to drive this by making the case for forests as a policy and business imperative, supporting a number of global coalitions to accelerate action and working with companies from across multiple sectors to take strategic action, integrating natural climate solutions into their activities through the purchase of carbon credits. This has allowed companies to realise their sustainability goals, including the launch of carbon neutral products to reduce scope 3 emissions for customers, protecting forest ecosystems close to supply chains, or to achieve net zero emissions. More generally, this has helped to prove the climate finance model by channelling funds that underpin the financial viability of projects and community benefit sharing.

From fashion to aviation, energy to technology, the past year has seen a boom in companies making net zero or carbon neutral commitments. In early 2020, Microsoft announced it would be carbon negative by 2030, which included a $1 billion climate innovation fund to accelerate the global development of carbon reduction, capture, and removal technologies. In 2019, Amazon committed to be net zero by 2040, a strategy which incorporated $100 million for reforestation projects around the world. Learn more about some of the key corporate commitments made.

Regulatory Markets

Negotiations that took place at COP25 on Article 6 of the Paris Agreement were ultimately unsuccessful in agreeing rules for international carbon markets. Countries could not reach a consensus on how to treat emissions reductions that were created under the Kyoto Protocol, the predecessor to the Paris treaty. Nor could they agree on accounting rules to track the flow of emissions reductions between Parties (countries) in future markets. Therefore, the market architecture for how natural climate solutions (or other emissions reductions) will operate with regard to international trading, framework for NDCs, national/jurisdictional/project-level accounting and registries has been delayed, with conversations not set to continue until COP26 in November 2021.

In the meantime, domestic carbon pricing schemes are continuing to be developed which may bring additional sources of compliance demand either for local projects (e.g. South Africa, Colombia, New Zealand) or potentially for international projects (e.g. Korea). Some countries also launched new domestic carbon crediting mechanisms such as the Bas Label Carbone in France which allow for the use of in-country climate finance and domestic carbon credits.

Covid-19 Impacts

In March 2020, the Covid-19 virus took hold across the world, resulting in tight lockdowns and huge health, culture and economic impacts in most countries. While pricing in regulatory markets such as the EU ETS were impacted, currently the international voluntary carbon markets have not experienced a similar crash. The voluntary carbon market is a strategic part of a company’s response to climate change which by its very nature is a long-term strategy. Annual purchasing decisions are often already committed to and tied to the previous year’s emissions and the momentum for a long-term drive to reach net zero emissions does not appear to be impacted with many major companies continuing to announce increased long-term ambition.

That said, expected demand growth could stall in the coming twelve months in light of lower 2020 emissions, wider economic challenges and potential disruption to supply as travel restrictions continue. For the airline industry specifically, it remains to be seen what long-term impact the depressed aviation demand from Covid-19 will have on the carbon market.

Overall, in 2019, the carbon market showed huge growth, with more companies taking strategic and holistic approaches to integrating natural climate solutions into their business models. Ecosphere+ continues to work with companies across multiple industries including natural products, FMCG, aviation, energy, finance, luxury, digital and retail to integrate natural climate solutions into corporate transition strategies which address climate change and biodiversity. With 2020 already a busy year, what does the future carbon market look like over the next 10 years? Explore our predictions here.