This blog was first written by Ecosphere+ Andrew Mitchell for a ‘Thought for the Day’ after his participation in the Prestel Family Office on the 2nd-3rd October 2017.

The concept of “Wealth that is Not Measured” lies at the heart of the emerging revolution underway today in the world’s economic thinking. The one we are living through. Simply put, it is that the true cost of things is not correctly priced and this leads not only to the degradation of nature but also the emergence of degraded human health and wellbeing.

Unfortunately, it is not just humans that suffer, destroyed forests are as much a victim of this, as the NHS suffering from an obesity epidemic. More than ever the Ecosphere+ approach to valuation of ecosystem services will need to be considered as one of the solutions that will help relieve this stress!

I sometimes think GDP could occasionally be described as “Gross Destructive Potential” rather than as a measure of a balanced sustainable economy. It was Sir David Attenborough who said that: “The only person who thinks that you can have infinite growth on a finite planet, is either mad or an economist”. It is for this reason that an alternative measure is being called for, that better provides for an economy where financial capital is in a far better state of equilibrium with natural capital, than it is today. This is especially important for impact investors in the emerging field of Natural Capital Finance.

Throughout this event, I have had the opportunity to engage with some of the richest families in Europe on these issues at the Prestel Family Office Forum in London. I was gratified to learn that these families and at least some of the Asset Managers advising them, were very aware of these issues. One of the reasons for this is because family wealth built over generations has a long-term view. My message to them was that the delivery of a world where natural capital has faded, is a disastrous legacy for their children and further, and that their wealth cannot be sustained inter-generationally under these conditions. By moving their wealth towards the kind of investment equilibrium needed, they can change the world and protect their interests.

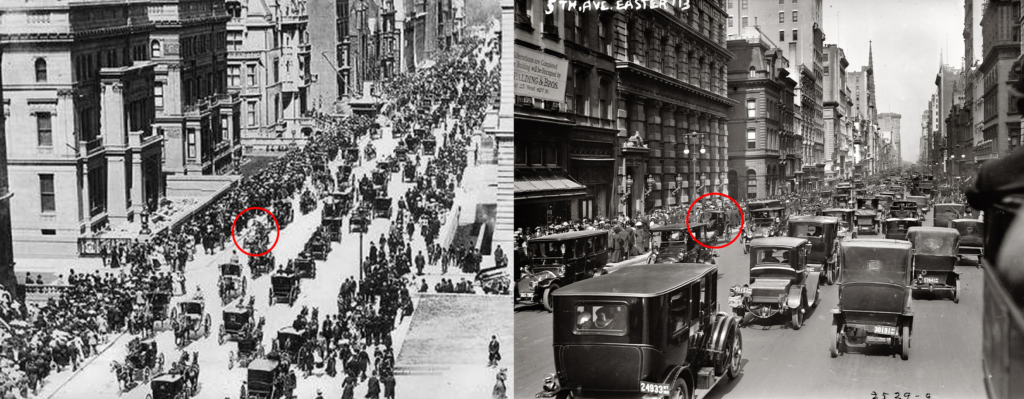

To give a real-life analogy, in 1901, horse drawn carriages filled the streets. A short 13 years later, there were none and had been completely replaced my cars. This kind of change can happen faster than you think. Think Tesla. Electric cars will soon be given away free, like phones, and their idle parked batteries rented out to store and manage energy on a renewable energy dominated grid.

Easter Parade on Fifth Avenue, New York (1900) (right)– Can you spot the car? compared to Easter Parade on Fifth Avenue, New York (1913) –(left) Can you spot the horse-drawn carriage?

Amongst some, especially where younger members are active, there is considerable awareness of these issues. They can become leaders that the world needs. They have the financial muscle required and are looking for new investments that can help foster this vital revolution. More so than ever, companies like Ecosphere+ will be increasingly in their sights.

To learn more about Ecosphere+ projects and how they are helping to implement this valuation of ecosystem services and thus protecting rainforests.